Regional Management (RM)·Q4 2025 Earnings Summary

Regional Management Beats Q4 on Record Revenue, Stock Jumps 4.5%

February 4, 2026 · by Fintool AI Agent

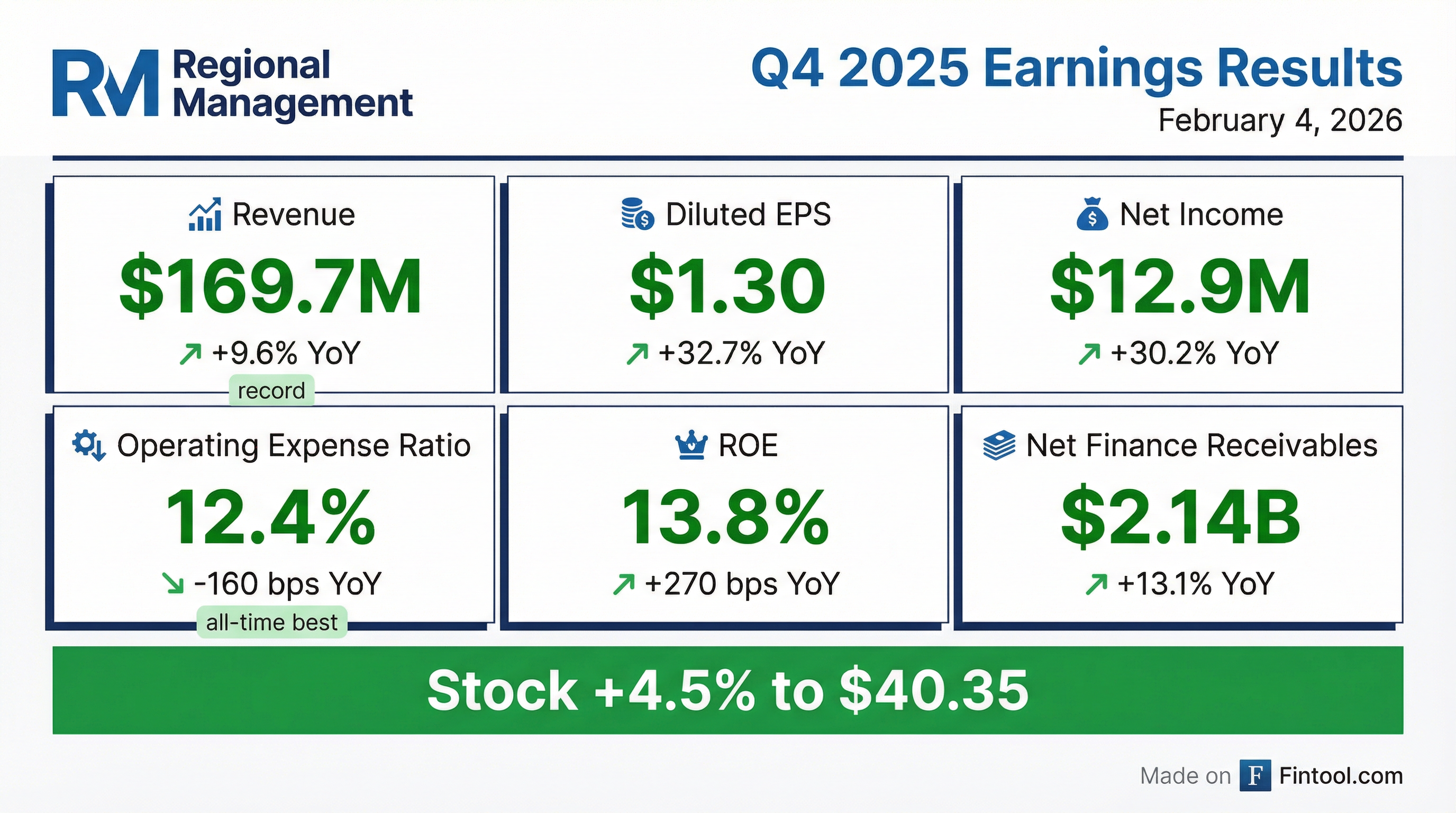

Regional Management (NYSE: RM) delivered a strong Q4 2025, beating analyst estimates on both EPS and revenue while posting record results and an all-time best operating expense ratio. The stock jumped 4.5% to $40.35 following the release.

New CEO Lakhbir S. Lamba, reporting his first quarter at the helm, struck an optimistic tone: "We delivered strong financial and operating results in the fourth quarter and finished 2025 with excellent momentum... As I step into this role, I am encouraged by the strength of the platform we have built and the opportunities ahead."

Did Regional Management Beat Earnings?

Yes — RM beat on both EPS and revenue.

This marks the third consecutive quarter of EPS beats for Regional Management. Net income of $12.9M was up 30.2% year-over-year, driven by record revenue and dramatically improved operating efficiency.

Full Year 2025 Highlights:

- Net income: $44.4M (+7.7% YoY)

- Diluted EPS: $4.45 (+7.5% YoY)

- Originations: $2.0B (+18.6% YoY)

- Revenue growth: +9.7% YoY

What Drove the Strong Quarter?

Record Revenue and Accelerating Portfolio Growth

Total revenue hit a record $169.7M, up 9.6% YoY, driven by 13.1% growth in net finance receivables to $2.14B.

Key growth drivers:

- Originations: $537M in Q4, up 12.9% YoY — a record quarter

- Customer accounts: 590,800, up 2.7% YoY

- Large loans (>$2,500): Now 74.4% of portfolio, up from 70.6% a year ago

- Auto-secured portfolio: Grew 42.4% YoY to $294M, representing 13.7% of total portfolio

The company opened 17 new branches since Q4 2024, which contributed $52.3M (21.1%) of the YoY portfolio growth. Same-store receivables grew 10.9% YoY, accelerating from 6.1% in the prior year period.

All-Time Best Operating Efficiency

The headline story is operating leverage. Regional Management achieved an all-time best operating expense ratio of 12.4%, down 160 basis points from 14.0% in Q4 2024 — the fifth consecutive year of improvement.

The company grew revenue by $14.9M (9.6%) while G&A expenses actually declined by $0.1M YoY. This demonstrates strong operating leverage as the branch network matures and digital capabilities scale.

How Did Credit Quality Perform?

Credit metrics remained stable with some improvement:

The adjusted net credit loss rate (excluding hurricane impacts) improved by 30 bps YoY, reflecting credit tightening and favorable product mix shifts. The Q4 2024 period benefited from a 50 bps tailwind from hurricane-related recovery activity.

The allowance for credit losses increased to $220.9M (10.3% ACL rate), up from $199.5M (10.5%) a year ago, reflecting portfolio growth while maintaining appropriate coverage.

What's the Funding and Liquidity Position?

Regional Management maintains a strong, diversified funding profile:

- Total unused capacity: $511M (subject to borrowing base)

- Available liquidity: $149M

- Fixed-rate debt: 84% of total debt, with 4.7% weighted-average coupon

- Q4 2025 securitization: 4.8% WAC, a 50 bps improvement from the 5.3% Q1 2025 securitization

The company's funding platform includes a senior revolving facility ($355M), warehouse facilities ($425M), a private securitization ($125M), and public securitizations ($1.26B).

Capital Returns and Shareholder Value

Regional Management continues to return capital to shareholders:

In 2025, the company repurchased 702,000 shares at a weighted-average price of $34.12, and increased the share repurchase authorization from $30M to $60M. The Board declared a quarterly dividend of $0.30 per share, payable on March 12, 2026 to shareholders of record as of February 19, 2026 — a 3.1% yield.

Capital generation totaled $73.7M in 2025, representing 20.3% of average stockholders' equity — demonstrating strong earnings power. Book value per share increased to $39.05 from $35.67 a year ago.

How Did the Stock React?

RM shares rose 4.5% to $40.35 on the earnings release, continuing a recovery from the December lows.

The stock trades at just 9x trailing earnings despite consistent profitability improvement and strong capital returns. Analysts have a consensus "Hold" rating with a $30 price target, though Wall Street Zen recently upgraded to "Strong Buy."

What Did Management Guide for 2026?

New CEO Lakhbir Lamba provided explicit full-year guidance for 2026:

Q1 2026 Expectations:

Management flagged Q1 will reflect seasonal credit patterns and expects the One Big Beautiful Bill Act (OBBA) to have a meaningful impact:

- Tax refunds expected to be ~20% higher YoY due to OBBA legislation

- ENR expected to contract sequentially in Q1 — potentially more than typical seasonal trend

- Delinquency rates should improve as customers use refunds to pay down past-due debt

- Net credit losses will increase sequentially due to normal Q1 seasonality (~150 bps increase)

CFO Harp Rana noted the company is shifting away from detailed quarterly guidance: "Short-term precision isn't always the most effective or reliable way to communicate our outlook. We're shifting to a full year view."

What Strategic Initiatives Were Announced?

Bank Partnership in Development

The most notable strategic announcement was a bank partnership capability that has been in development for several quarters:

"We believe a bank partnership model could provide meaningful strategic benefits over time, including faster entry into new markets, greater product and operational uniformity across states, the ability to broaden our product set, and optimize risk-adjusted yields." — CEO Lakhbir Lamba

When asked about becoming a bank outright (given easier regulatory environment), the CEO indicated the near-term focus remains on executing the partnership initiative, though they will "continue to evaluate the landscape as it evolves."

Digital and AI Investment

The CEO emphasized significant opportunities in technology:

"My initial assessment of our digital capability, origination, and servicing customer journey indicates numerous opportunities to improve both the customer and team member experience. We believe investment in digital and AI will help us grow origination and lower our cost to originate and service our loan book."

Geographic Expansion

- Opened 5 new branches in Q4 in California and Louisiana

- Additional branches planned throughout 2026

- Potential for new state expansion beyond current 19-state footprint

Q&A Highlights

On Macro Outlook:

Management expressed confidence in the consumer, noting the FOMC's assessment that "the economy has been growing at a solid pace." Key indicators they monitor:

- Open jobs still at 7 million

- Inflation moderating

- Real wage growth continuing in lowest quartiles

- Gas prices down from last year

On Pricing Strategy:

CFO Rana explained pricing philosophy: "We really look at pricing in context of where the market's at... The consumer in this segment is usually most concerned about their monthly payment." Management confirmed they have not programmatically extended duration to manage payments.

On Marketing Efficiency:

Marketing costs improved QoQ and YoY. CFO noted: "We've become much more efficient around our mail... If demand is strong and those folks meet our risk box, we will probably redeploy some of those expenses in order to grow the business."

On Same-Store Growth:

Same-store receivables accelerated to 10.9% growth YoY, demonstrating the maturation of the branch network beyond just de novo contributions.

What to Watch Going Forward

Management's Strategic Priorities (per new CEO):

- Growing auto-secured portfolio with compelling credit performance and returns

- Executing bank partnership initiative for faster market entry and product uniformity

- Expanding thoughtfully into new markets with potential new state entry

- Investing in digital and AI to improve origination and lower costs

- Driving sustainable, profitable growth and higher ROE

Positive Catalysts:

- Continued operating leverage from branch maturation and digital scale

- Auto-secured product growth expanding the addressable market

- Strong capital generation supporting buybacks and dividends

- Interest rate sensitivity favorable with 84% fixed-rate debt

Risks to Monitor:

- Consumer credit environment and unemployment trends

- Exposure to hurricane-affected geographies (Texas, Florida, Carolinas)

- Regulatory changes affecting consumer lending

- Competition from fintech and digital lenders

Key Financial Tables

Quarterly Income Statement Trend

Full Year Comparison

Regional Management Corp. (NYSE: RM) is a diversified consumer finance company providing installment loans primarily to underbanked customers across 19 states through 353 branches and digital channels.